The current CMA report “Anticipated acquisition by Illumina, Inc. of Pacific Biosciences of California, Inc. Decision on relevant merger situation and substantial lessening of competition” makes for some interesting, if frustrating, reading. Interesting because of what the report says but frustrating because of the redaction (see what Keith says about that at OmicsOmics). ONTs Clive Brown pointed to coverage on Motley Fool, and I’d recommend Seeking Alpha’s piece by Stephen Simpson.

The major news is that the CMA see the merger as problematic. They say it will reduce competition and choice in the marketplace, which I’d agree is very likely to be true. They also lump short-read and long-reads sequencing into the same category which is likely to be a big issue for Illumina as they try to argue that the two methods should be considered as separate technologies. If the CMA gets its way then this deal could be off – which would result in a $100 million payment for PacBio (not so bad for them and a drop in the ocean for Illumina).

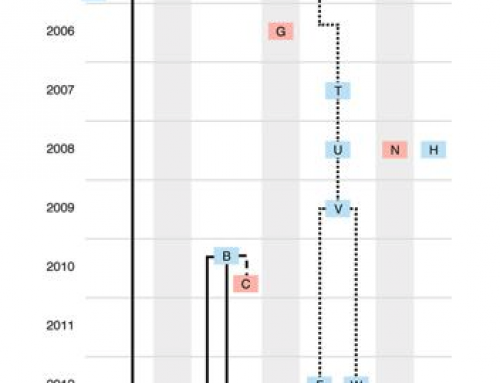

Digging deeper into the report you can see the evidence the CMA has considered in it’s assessment that short-reads and long-reads and substitutible. This comes from 4 sources (1) Internal documents; (2) Industry reports; (3) Third party evidence; and (4) Bidding data.

Paragraphs 73 to 80 are particularly enlightening as Illumina’s own internal documents clearly highlight the likelihood of convergence between short-read and long-read technologies, and the “substantial risks” this poses for Illumina. Analysis of bidding data (presumably from all those University tenders) shows that users rarely specified read-length in the tendering process. The views of Illumina and PacBio (presumably as expressed to the CMA) appear to be somewhat at odds with their marketing and scientific claims (para 107). PacBio in particular appear to have claimed that their Sequel2 outputs will not become competitive with Illumina and that they will not cannibalise short-read applications – anyone who’s been to a PacBio talk n the last two years is likely to have come away thinking the opposite.

Competition from ONT: There is much less detail here than we might have hoped to see. And one big omission is RNA-Seq, which may well be the hands-down winner in long-read methods as users move to isoform sequencing rather than bog standard short-read cDNA DGE. Fortunately for ILNM:PACB the CMA had feedback from some ONT users that “ONT’s technology was not performing well and that its low accuracy”, I don’t know how many customers they were referring to but I doubt they are active on Twitter 😉

ILMN+PACB genomes: The CMA finish up by discussing the potential for Illumina to offer “Mixed bundling” on sequencing where a combined ILMN+PACB package woudl be available under thie merger at a lower cost that the separate technologies. And that this is likkely to even more significantly restrict competition.

My first thought on hearing the $100 genome news was that users might couple it to a $900 Sequel2 PACB genome for “the best $1000 genome we can get”. If Illumina can do that on their own then ONT would certainly find things harder in the WGS space.

If the price for an SBS genome drops to $100 and a @PacBio genome is $900 do we have the best $1000 genome we can get? How does it compare to @nanopore ? Roll on @jpmorgan 2019.

— James Hadfield (@coregenomics) November 3, 2018

And finally: The last part of the CMA report is on “Countervailing buyer power”, which is the ability of customers to use their negotiating strength to limit price rises. I would argue that the CMA only has to look at the cost of the the genome and see that 5 years of stable prices suggests Illumina has already beaten customers into submission.

The CMA review is shedding a light into the dark corners of the NGS world. But I remain as conflicted as I was before; on one hand I don’t think this is a good deal for NGS users, but on the other I hope Illumina can turn PacBio into a larger success story. And I think the likelihood of it getting pushed through politically has increased with our own version of Trump in at No. 10.

James, what do you think will happen to PACB if the merger doesn’t happen? They’ll get a $100M payout, but how long do you think they can last on their own?

PAcBio’s latest generation of instrument, chip, chemistry and software really seem to have finally hit the spot. Failure of this deal for them could be a good thing if they genuinely have the product they are talking about. I think there are enough de novo WGS users out there now who can see the benefits that PacBio can sell in reasonable volumes. And a $100M handout from Illumina won’t hurt!

However, if the Illumina deal does not go through I wonder if PacBio will be snapped up by someone else pretty quickly?

Why do you think BJ’s premiership increases the likelihood of the merger going through?

This is a little tangential, but why does the CMA have any authority over whether a merger between two American companies takes place?

BJ might look at this as a good deal to help the USA push through. Even though it almost certainly is not in the interests of consumers (the largest of which in the UK is likely to be MRC, CRUK, UKRI i.e. public funding of some kind.

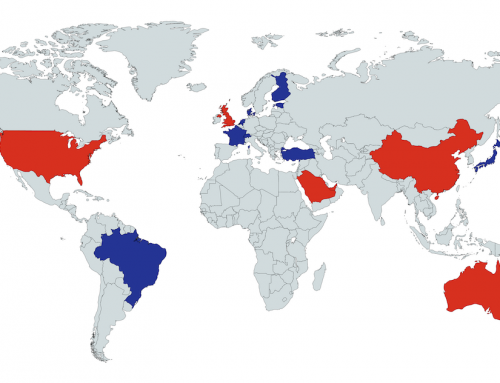

I really do not know why the CMA gets such high billing here? I’ve not seen anything similar from France, Germany, ROW.

The CMA is independent from political interference like the FTC in the US. The CMA can stop mergers of US companies in the same way, by international conventions, the FTC can block mergers of European companies.

Any updates on your great article? What are your sentiments about the merger being nixed?

[…] on OmicsOmics (a lot of coverage by Keith, and far more than he’d anticipated) and I on this blog. The story has subtly shifted to one focused on the UKs CMA (Competition and Markets […]

[…] whether the takeover would be good or bad for PacBio and their customers (you can read what I said here and […]