OK so Illumina is not (to my knowledge) planing on sponsoring the San Diego Padres. The title of this post was inspired by a wonderful bit of mistaken transcription of the recent Goldman Sachs Healthcare conference presentation by Francis deSouza “sequencers today generate baseball”…I think he probably said basecall! However, there was lots that was interesting in the call including a little bit about the PacBio purchase the CMA just pushed back on (more on that at the end of this post), Nationalomics and Illumina’s revenues.

Nationalomics:

Francis talked about the success of the Genomics England project (well done TeamUK) and the stimulus it has created for follow on National genome sequencing initiatives (UK, US, China, Saudi Arabia, Australia, Turkey running 100k or bigger projects; and France, The Netherlands, Switzerland, Estonia, Finland, Denmark, Japan, Brazil, and Qatar running other genomics initiatives – this is a non-exhaustive list. See also Stark et al AJHJ 2018).

Illumina believe that the recent Edico genome purchase allows them to offer a full pipeline to any country that wants to follow on from GeL, and solving some of the headaches that project faced (I know some of them intimately) e.g. FFPE vs FFZN: “For example,one of the things we learnt in the U.K., was for the NGS testing to select therapies for cancer patients you really want the tumor to be fresh frozen samples, not FFPE because you get too much degradation and we had to rework the accession protocol for tumors”.

Illumina’s revenues:

Francis highlighted that the largest portion of Illumina’s revenue comes form reagent sales and not from selling boxes (although MiSeq, NextSeq and NovaSeq) still make up “mid-teens percentages” of total revenue. The SEC filing for 2019 Q1 shows Illumina made $699M from sequencing; 70% was consumables (at >70% gross margin), 11% was instruments and 13% was “services”. Given that Illumina have been selling the $1000 genome for a few years now, and that National Genomics initiatives are looking to deliver tens of millions of genomes in the next decade – their profitability looks pretty certain for the next 3-5 years.

PacBio:

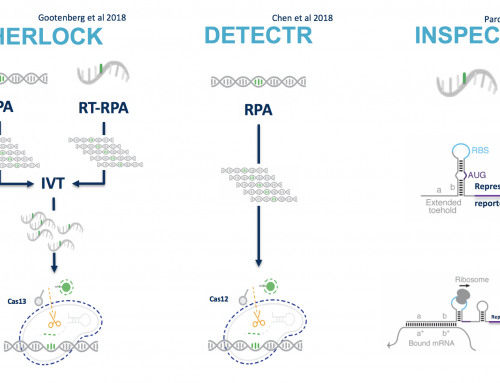

The announcement of the PacBio purchase was a surprise but it is clear that one of Illumina’s biggest threats are long-reads. Once we can sequence with long reads as cheaply and conveniently as short-reads then we’ll switch (excepting FFPE and cfDNA); and longreads for RNA could mean the death of short read even for DGE in the relatively near future. Franics said that Illumina see longreads as “about 5% of the overall sequencing market” today. And that users are focusing on this in applications where short-read won’t deliver e.g. new reference genomes or organ transplant genomics.

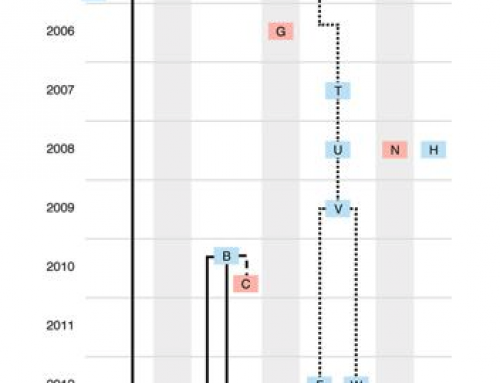

The PacBio acquisition will require approval (he mentioned the U.S. and in the U.K. only in this context) and the most recent announcement from the CMA is a setback. The CMA said that it “has concerns that the deal could remove potentially the most significant competitive threat to Illumina”. They did not mention Oxford nanopore in their press release, although I heard they have been lobbying hard. PacBio may finally have a sysytem that can compete with Illumina (and ONT), so a merger removes a competitor and allows Illumina to fight harder against ONT. I’m conflicted; on one hand I don’t think this is a good deal for NGS users, but on the other I hope Illumina can turn PacBio into a larger success story.

Ultimately this feels like a done deal to me and even with the reduction in competition I think it’ll get pushed through politically.

James, why do you think this isn’t a good deal for NGS users? What do you think will happen if the merger goes through? What do you think will happen to PacBio if the merger DOESN’T go through?

“on one hand I don’t think this is a good deal for NGS users, but on the other I hope Illumina can turn PacBio into a larger success story.”