Yesterday Illumina and Qiagen announced a 15 year deal to partner on development of NGS in vitro diagnostic kits to run on Illumina sequencers. And Qiagen, more quietly, announced that development of the GeneReader platform will cease. The second piece of news is unsurprising; I’d written about Qiagens purchase of the Intelligent Bio-Systems technology that GeneReader was built on back in 2012. Back then I’d written that it was “not clear if a Qiagen sequencer can compete against Roche, Life and Illumina in the research or clinical space”…oh how much has changed since 2012!

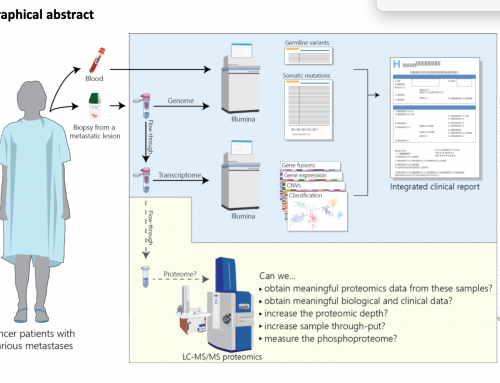

Qiagen has been flogging the GeneReader sequencing system since 2015, but not very successfully, against a much more dominant Illumina and a second-place Thermo Ion Torrent in the clinical space. So the move to work more closely with Illumina rather than continue to develop the IBS technology is unsurprising and suggests someone won the battle internally to focus on the most likely opportunity for growth of their “Sample to Insight” portfolio i.e. the assay kits. Essentially, Qiagen has decided to focus on selling razor blades leaving Illumina to sell the razors. Qiagen will also be involved in commercialisation of Illumina’s TruSight Oncology assays (TSO500). And they get access to Illumina’s MiSeq Dx and NextSeq 550Dx systems as well as future clinical sequencing systems Illumina might launch: NovaSeq Dx at JP Morgan?

Illumina

partnered with their other NGS rival Thermo-Fisher in early 2018 opening up AmpliSeq (arguably the best-at-the-time PCR-amplicon NGS method). However, they did not license the IVD use of this technology for their sequencers and Thermo control that side of the market leaving Illumina to focus on RUO only at this time. I am not sure what impact this deal had on sales of AmpliSeq, but it can’t have hurt either Illumina or Thermo (if you have any insights please drop me a message).

Benefits for clinical sequencing

In yesterdays

press release Illumina CEO Francis deSouza was quoted saying

“We are committed to expanding the range of clinical use cases addressed by genomic sequencing by enabling partners to deliver IVD tests and companion diagnostics on Illumina’s Dx instruments,”. Many companies are working in the clinical space:

Roche/Foundation Medicine (F1CDx),

Guardant Health (360),

Thermo Fisher (Oncomine Dx),

Predicine (GeneRadar),

PGDx (elio plasma and tissue),

Inivata (InVisionFirst),

Agilent,

Myriad Genetics (who just bought a PacBio Sequel2), and

Natera, opening up clinical sequencing to benefit patients. This new partnership is likely to get more physicians sequencing as a diagnostic, and that has to be a good thing, but it reduces competition in the clinical NGS space which brings me onto the Illumina acquisition of PacBio.

Illumina + PacBio

The news that Illumina intended to acquire Pacific Biosciences for $1.2B created something of a stir in the relatively small genomics community. The biggest concern for NGS users was how competition might suffer as the hugely dominant Illumina expanded its reach into the long read space. Shawn baker at SanDiegOmics covered the announcement as did Keith Robinson on OmicsOmics (a lot of coverage by Keith, and far more than he’d anticipated) and I on this blog. The story has subtly shifted to one focused on the UKs CMA (Competition and Markets Authority) who should release a final assessment on, or before, their Statutory deadline of 11 December 2019. That is unless of course they kick this can down the road like the UK Parliament is doing with BREXIT (but lets not go there)!

The most recent word we have from them is from Illumina’s own submission, a summary of customer calls (disclosure I was one of those customers) and a personal response by Shawn Baker. Qiagen does not figure heavily in these documents (just once in the user submissions and not alt al in Illumina’s) but the CMA is likely to look at the withdrawal of a player form the NGS space as reducing competition in that particular market – whether long or short read. How the news wil impact the CMA assessment may come out when they release their decision.

I am broadly on the same page as Keith; Illumina is acquiring PacBio for its commercial potential that is complementary to SBS, and that this deal will be good for PacBio users by bringing Illumina’s engineering and sales & marketing forces to bear. Equally, if the acquisition goes through competition in the medium and longer term will suffer as companies like ONT will have an even bigger beats to fight against, and new entrants to the NGS market might find it almost impossible to get the investment they need to get out of stealth mode.

Like this:

Like Loading...

Related

[…] up the momentum and break through the US courts? Qiagen was the most recent sequencing company to throw in the towel; killing off further development of their IBS technology – the Walmart/Aldi of the sequencing […]