This update was added on 11 July 2012: An article on GenomeWeb made interesting reading as it talked about the current litigation between Columbia University and Illumina. In it Thomas Theuringer (Qiagen PR Director) said “We support Columbia’s litigation against Illumina, and are also entitled to royalties if we prevail”. Maybe the royalties will be worth the reported $50M they paid?

Qiagen has just purchased Intelligent Bio-Systems and is, for now, the new kid on the NGS block. But what does IBS offer, what are the MaxSeq and Mini-20, can they compete against the monster that is Illumina and who owns the rights to SBS chemistry?

The Max and Mini instruments have been on my radar for a year or so now and I really did not think they would compete against Illumina when I first heard about them. I think one has been installed in Europe.

The instruments use technology from the noughties with maximum read lengths of 55bp and 1/3rd the yield of HiSeq. If the instrument and running costs are cheap enough users might be tempted. However a cheap alternative to a gold standard often turns out to be a disappointment.

If the title reads a little harsh then I’ll explain some of my thinking below.

*Aldi and Wal-Mart have a reputation in the UK for cheaper and lower quality products, they offer an alternative to supermarkets like Sainsburys. You should not make any NGS purchasing decisions based on a personal preference of where I like to do my weekly shop!

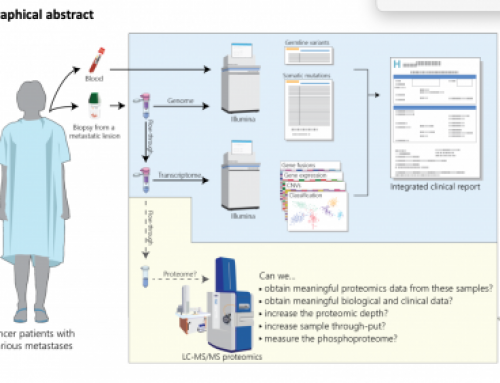

What did Intelligent BioSystems offer Qiagen and is there space in the NGS market for another player: Qiagen wants to get into the diagnostic sequencing space. However it is not clear if a Qiagen sequencer can compete against Roche, Life and Illumina in the research or clinical space. Clinically Roche already have a strong diagnostics division even if their 454 technology appears to be suffering with the strong competition of MiSeq and PGM. Illumina have thrown their weight behind clinical development and have a reputation for investing in R&D so expect them to become a major player. Life have a reputation for delivering products that work (lets ignore SOLiD) and the continued development of PGM and now Proton has got to keep them in a strong position.

Can Qiagen take any market share: The instrument will have to work robustly, deliver high quality data, be competitive on cost and include bioinformatics solutions. It is not clear what will differentiate the Qiagen instrument from others already widely adopted.

Although I think it is going to be tough for Qiagen it is not impossible; and if there is a $25B diagnostics market (UnitedHealth Group’s personalized medicine paper suggests that the molecular diagnostics market could grow to $25bn by 2021), even a 5% share of this is equates to $1.25B!

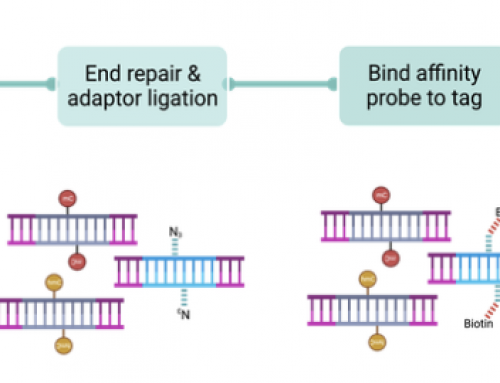

What will the Qiagen sequencers look like: The sequencers offered by IBS make use of sequencing-by-synthesis technology licensed from Columbia university. This technology was published in 2006 by Jingyue Ju in Nicholas Turro’s chemical engineering group at Columbia University. Their PNAS paper describes a system that will be familiar to anyone using Illumina’s SBS. 3-O-allyl-dNTP-allyl fluorophores are incorporated by DNA polymerase, imaged and then cleaved with Palladium catalyzed deallylation ready for the next cycle. They sequenced 13bp in the 2006 paper at almost the same time as Illumina were buying Solexa for $600M.

Perhaps the most intriguing aspect of the technology is that the flowcells are reusable! Sounds great, but will clinical labs see this as a benefit over disposable consumables? I think not as there is too much risk a sample will become contaminated. The same goes for removing the need to barcoding on Mini-20 by using a 20 sample carousel. Barcoding is useful in labs just for sample tracking even if you end up doing a run in a single lane/flowcell.

Max-seq: In the brochure they claim that “thousands of genomes have been sequenced utilizing 2nd generation technologies, such as the MAX-Seqâ€, I would argue that 10,000’s of genomes have been sequenced but I am not aware of a single Max-seq genome to date.

Library prep uses ePCR bead-based or DNA nanoball (Rolony) methods. Libraries are loaded onto a flow-cell and sequenced with SBS chemistry. The instrument has dual-flowcells and each will generate 100M reads per lane in single or paired-end format at 35 or 55bp length, with >80% of bases being Q30 or higher.

The Azco website suggests that the Max-seq is thousands of dollars cheaper than a SOLiD or HiSeq instrument, and that run costs are 35% cheaper than Illumina or ABI. If you only get 25-50% of the data this make the system cost more like twice as much per run for lower quality data and much shorter reads.

Mini-20: I am not certain the Mini-20 actually exists yet. The brochure on the Azco website has a picture of the Max-seq with a line drawing of a flowcell carousel. The carousel should allow loading up to 20 flowcells and run up to 10 samples per day (SE35bp). A flow cell will generate 35M reads in single or paired-end format at 35 or 55bp length, with >80% of bases being Q30 or higher and 4Gb per flowcell.

Cost per run is predicted to be about $300 per flowcell. However it is not clear what the price would be if you wished to dispose of the reusable flowcells after a single use.

Those numbers do not add up to me but they must have made sense to Qiagen.

I know people and labs have been using Illumina's sequencing technology for years now. However, I am surprised you could call it the "gold standard". Its neither true bi-directional sequencing nor are both the strands of DNA sequenced. You cant even see the sequence raw data!! Anything like electrophorograms or pyrograms. all you get is a FASTa file with a quality score. I am sure it works and the insilico part is well tested and validated in base calling. However its still too edgy to trust the machine, particularly in diagnostics.

Would love to hear your thoughts.

Let me explain my predicament a bit more clearly. I work in molecular diagnostics in a cancer setting. We are working on amplicon sequencing for clinical genotyping of tumour samples at ultra deep levels (>2500x coverage atleast). We routinely see 30-50 bp deletions and duplications and delins. How do you think these work at bridge PCR stage? Because of the read length limitations of the "Gold standard" technology the amplicon cant be longer than 250-350 bps. a 40bp deletion or insertion accounts to almost 10% change in the physical length of the amplicon. Can bridge PCR cope with that in your experience? Can we issue a diagnostic report on a cancer patient based on a single strand/single coverage/single directional sequencing?

Please dont think I am ranting. Its a genuine question.

Bridge PCR should be tolerant of this length difference as we can successfullly sequence smallRNAs at 100bp fragment length.

I do not think you can make any judgment based on a single strand single sequence. NGS is all about coverage to get confidence and coverage is cheap.

I think Illumina is the gold standard for NGS and the fact you cant see the trace is something we all have to get used to. The quality is better than Sanger, although certainly not as pretty.

Life have a reputation for delivering products that work (lets ignore SOLiD) and the continued development of PGM and now Proton has got to keep them in a strong position. Thanks for sharing.

breast cancer treatment

Well Done Work In Biosciences, this is the way to recognize well documentation of the well established plan to test DNA in health issues.Make it better by Dna Genetics Diagnostics.

Do you love shopping at Aldi. Download the FREE app at https://itunes.apple.com/gb/app/aldi-shopping-list/id939510733?mt=8