The new G4 benchtop sequencer from Singular Genomics is here. Sept 17th 2021 saw the first picture of the G4 in the wild from Beth Israel Deaconess Medical Center (see below). For anyone still recovering from a 2021 New Year’s hangover, the G4 is a direct NextSeq competitor and Singular will be looking to take significant market share from Illumina in core-labs and clinical-labs that are running their own sequencing in-house. But at $350,000 for the instrument, compared to Illumina’s NextSeq costing around $335k, and with similar per Gb sequencing costs, will anyone buy it?

A major question for any of the nascent Illumina competition (Singular Genomics, Element Biosciences, et al) is how many of these user will switch. Much of the decision will be based on how easy this is and how much money they will save. With well over 400 Illumina NGS methods out there it is clear that delivering a machine that can do RNA-Seq will not be enough. So compatibility with Illumina-libraries, library-prep workflows and/or at least with bioinformatics tools is likely to be high on the wish list of potential buyer.

Overall, the improved flow cell flexibility and sequencing speed mean the G4 compares well to NextSeq but whether this makes the box attractive enough to a similarly priced Nextseq 2000 will be shown by instrument placements over the next 12 months.

An overview of the G4 sequencer:

G4 treads a the well worn path of SBS but uses a novel chemistry and other engineering innovations to deliver NGS data to users. It looks like the chemistry was licensed from Jingyue Ju’s lab although details of the SBS and clustering chemistry not been formally disclosed as far as I am aware, and a recent GenEdge article apparently sheds some light on this but is behind a paywall. There are hints out there (see this post at 41j blog, which describes some of their patents). But the patent I found most interesting is the US20210040555, which describes a bead-based clustering with beads arranged two-dimensionally in flow cells. This probably means no ExAmp and therefore no significant problems with index hopping (first described by me in Dec 2016 and by Rahul Sinha in early 2017), which may carve the Singular technology a niche in ctDNA analysis. Patterned flowcells coupled to NVIDIA GPU base calling and automatic demux with FASTQ file output help keep sequencing times short and G4 should be up to 3x faster than NextSeq for an equivalent run.

Singular have two documents available to download on their website; the G4 Specifications and a Technical Report and both need you to enter your details. I’ll summarise the most interesting bits in these in the rest of this post.

G4 Specifications:

The G4 spec-sheet highlights the use of a proprietary 4-colour SBS chemistry, which uses novel nucleotides, engineered enzymes, and proprietary methods to deliver Singular’s paired-read sequencing reads. The G4 can run 4 flow cells, each with 4 lanes and all 16 of these are independently accessible, although once you start a run it needs to finish before you can kick off another lane/flow-cell; so although you can run just a single lane there are limits on when a flow cell or a lane can be started. As such G4 does not offer fully independent flow-cell usage, like PromethION but also does not have some of the same flexibility of the semi-independent flow-cells on NovaSeq.

Slide from Singular

The flow cells come in two densities F2 and F3 which offer 150M and 300M reads respectively. And you can generate 1x50bp to 2x150bp reads with the different kits available. A 1x50bp run will be completed in as little as 6 hours making this great for that fast turnaround RNA-Seq or ChIP-Seq experiment, and 2x150bp will take a minimum of 16 hours; this compares well to the NextSeq which takes 11 hours for 1×75 and 29 hours for 2x150bp. The smaller size of Singular’s SBS cycle kits is because they don’t include the indexing chemistry when sizing the kits – the kit does contain the reagent overage required so you should have no problems doing your index reads. Sequencing quality is >75% Q30 reads across all kits.

Comparing this to Next-Seq 2000 specs,of 130M & 400M flowcells offering up to 2x150bp reads across a single, and giant, four lane flowcell – with only one pooled library being run across all four lanes, shows how well Singulars G4 stack’s up (Table from Albert Vilella on Twitter). NextSeq 2000 has the P3 up its sleeve offering nearer to NovaSeq capabilities for the users that need to go deeper for e.g. single-cell sequencing experiments but a fully-loaded G4 can get to the same 1200M 2x150bp reads.

Technical Report:

The data presented by Singular include the very well sequenced NA12878 (how much data is out there?). 100ng of NA12878 DNA was PCR-free library prepped using the SparQ DNA Library Preparation Kit (Singular are not getting into the library prep business). This includes sparQ UDI stem-loop adapters (not sure how they get around PacBio’s IP here). Two runs of two F2 flow cells generating 2x150bp reads were analysed generating 692M read-pairs (mean of 173M read-pairs per flow cell), with around 90% of bases at Q30 or higher. The report goes into lots of detail with regards to coverage uniformity, error modes and sequencing accuracy which all look at least as good as Illumina.

Interestingly, the data suggested a drop in coverage in higher GC content regions, although the plot only shows the 20th-70th percentile (see figure below for my comparison to one of the earlier Illumina CGI, PGM papers) – this could be fixable with chemistry mods (unlikely) or base-calling (possibly) – ultimately the instrument needs to get in the hands of users and we need to see more data in the public domain.

Unfortunately, the methods section does not describe in any detail the library prep or clustering chemistry, which many users will want to get details on so they can understand how easy (or difficult) it might be to switch from Illumina-based methods. But it does describe the bioinformatics methods, which appear to be pretty standard (caveat – I am not a bioinformatician): bwa-mem alignment, GATK analysis and DeepVariant variant calling.

All-in-all the methods described appear very Illumina-compatible – you simply swap out Illumina adapters for Singular’s own version. So whilst it does not look like you can switch libraries across instruments e.g. ILMN on G4 and vice versa the very high compatibility with Illumina based methods means switching is going to be very easy for most users. Importantly, this high-compatibility means that users working on difficult samples will NOT have a more difficult time on G4, so if you are working on FFPE RNA-Seq you’ll be no worse off than Illumina.

A little bit about PX

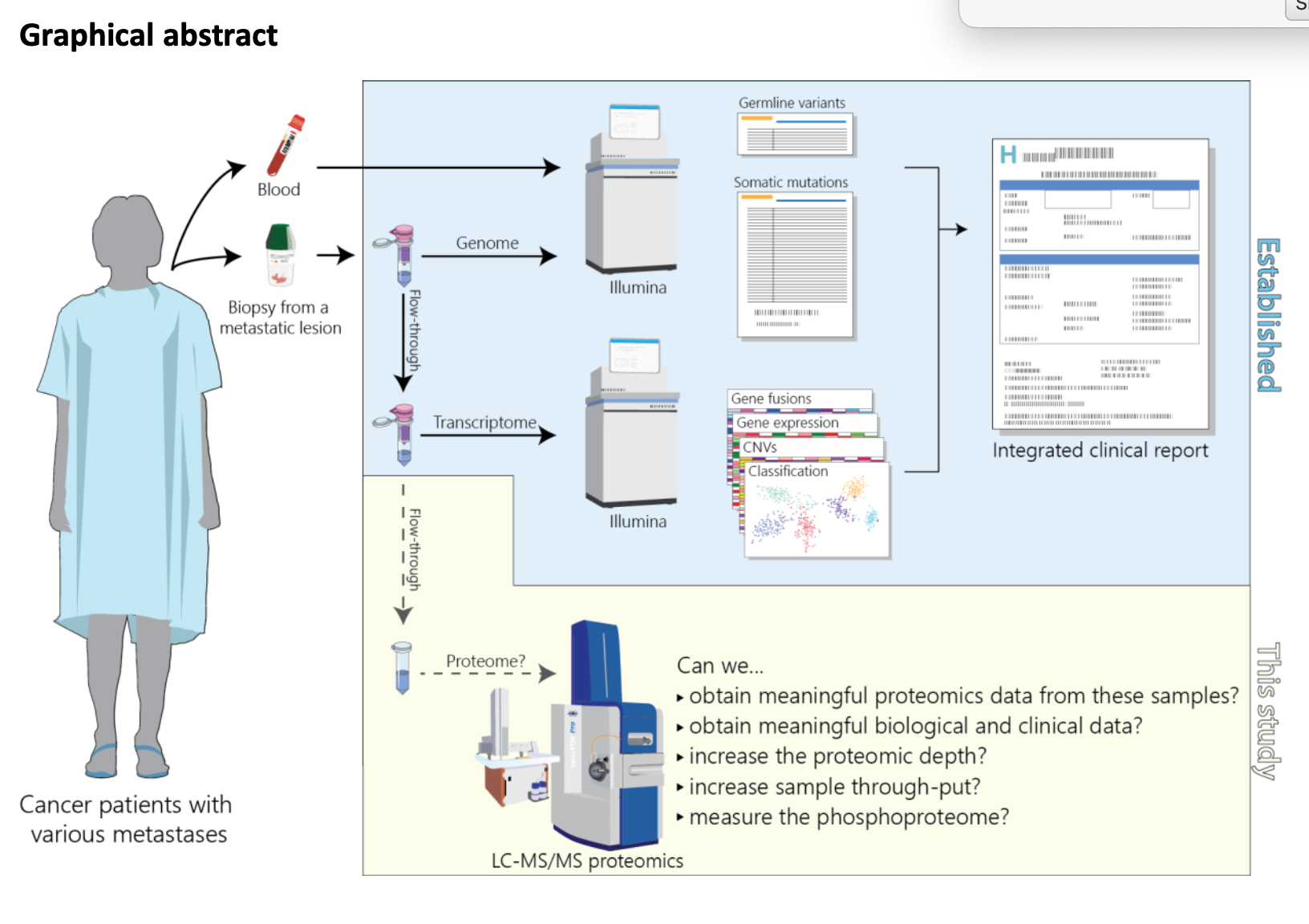

I’d like to hear more about Singular’s NovaSeq ambitions – ultimately this is where Illumina make their big bucks and where competition is sorely needed. However, the PX Integrated Solution is NOT a NovaSeq replacment. According to a Singular press release the PX “combines single cell analysis, spatial analysis, genomics and proteomics in one integrated instrument providing a versatile multiomics solution”. Their SEC S1 filing gives some detail and decribes a single-cell sequenciner on steriods: the “PX Instrument will use a well-plate approach (either with a 96 or 384-well consumable plate) designed to process 10,000 to 100,000 cells per well at a throughput of 1 million to 10 million cells in a 96 well plate…[for] spatial analysis…we expect to run up to 96 tissue samples per run.“

PX is also being touted as a solution for oncology and immunology, primarily in blood cancers. If the system can characterise blood cancer cells phenotypically (via DNA conjugated antibodies – think CITE-Seq) and generate DNA and/or RNA (BCR & TCR-Seq) sequence data then it could have a big impact – but only if the instrument lowers total costs compared to Illumina (not what Singular are attempting with G4) and if the instrument is adopted/cleared for clinical use.

The S1 highlights a Synthetic long read method on PX that enables up to 2,000 to 3,000 base pairs although onlye 450 base reads with B cells for VDJ sequencing have currently been demonstrated.

PX is scheduled to launch in 2023 and if you are interested in where Singular are going then I’d recommend the Singular S1 review on the 41J blog (written by Nava Whiteford and you’ll find loads of great stuff on there).

Final summary:

Singular are entering a market where competition has been severely lacking for well over 5 years and some would argue for close to a decade. The $5 billion NGS market is owned by Illumina, who’s instruments generate nearly all the data (>95%) and with massive market share (>75%). The GRAIL deal, Illumina’s biggest ever acquisition, may help companies like Singular persuade liquid biopsy companies like Foundation Medicine, Guardant Health, Invitae and others to switch sequencing technology providers. But the big users of NGS technology really need the high-throughput end of the market to offer real competition and until Singular can add a NovaSeq-beater to their offering I doubt we’ll see big shifts in the market.

I am surprised that Singular are not competing on price. Whilst this would be a race to the bottom, which Illumina’s might win because of their cash-in-the-bank, I am not sure that the 3x faster speed, and increased run flexibility, over NextSeq will be enough to tempt users to switch; particularly as tehre are no capital cost-savings over NextSeq either. For some core labs the money saved on individual runs might make them price-competitive to larger centres meaning they keep users who are overly price conscious. Or they are able to fill that rapid turn-around niche without sacrificing too much on price.

We definitely need to see more data from users to understand the impact of any G4 specific biases or error modes. I’d worry that the slight dip in high GC coverage would make bisulfite (or enzymatic) methylation sequencing more difficult for instance.

As such the next 12 months will be interesting to say the least. Will Singular place over 100 instruments? Who else will make announcements at JP Morgan or AGBT? What will Illumina do to beat off this competition – do they even care?

[…] Previous […]

[…] (link to spec sheet) today and Illumina now have two new competitors in almost as many months (read my post on Singular from January). The Element pitch is to offer the highest data quality, lowest cost, and best flexibility on a […]

[…] and if you are interested in details about their G4 I can refer you to their website and to James Hadfield’s post about the Singular G4 here, where he digs a little into the platform performance. Of course with four independent flowcells […]

Thanks Dale. What did you make of Illumina’s announcements?

Hi James, I’d be curious what your thoughts are on Ultima Genomics.

Hi Benoit, I’m reviewing some data we generated and so have not posted…yet! Watch this space. And abstract just submitted to AGBT.